ClearScore UK Review for 2023

CLEARSCORE REVIEW 2023 – CLEARSCORE UK

Looking for an easy, and hassle-free way to find out your credit score before applying for credit? Continue reading this article about ClearScore UK – Review.

To be eligible for loans or other finance agreements at favorable terms, it is essential to have a healthy credit score. Maintaining a high credit score requires constant attention.

ClearScore, a UK-based FinTech company, makes their customers’ credit scores and reports free of charge. ClearScore UK offers credit scores and tips to improve their credit score for free. There are many companies that allow customers to check their credit online.

ClearScore was founded in July 2015, and in November that year was named Innovator-of-the Year by the Growing Business Awards.

ClearScore UK gives people access to this information using Equifax’s credit scores, reports, and other information. ClearScore partners with financial institutions to market their products and earn commissions if users sign up for or purchase that product or service. It is a “financial marketplace,” providing information to help people understand their financial situation, and then offering products and services that may be of interest.

The company is now based in the UK. With more than 12,000,000 users, South Africa and Australia are now the two main markets. ClearScore Protect now offers identity protection. This product scans for security flaws and assists users in avoiding identity theft or fraud.

WHAT DOES CLEARSCORE DO?

There are three major credit reference agencies in the UK: Experian Equifax, TransUnion, and Equifax. Each agency collects information about individuals’ financial history, credit histories, and personal circumstances. The credit report is then referred to as a credit score. Lenders can then use the report and score to decide whether they will offer products like credit cards, loans, or mortgages. If so, how much to charge, and what credit limit, Each agency has its own data and analyses them differently, so there is no one credit score. It’s best to review your credit report with each agency.

CLEARSCORE EQUIFAX

ClearScore free app differs from Equifax, TransUnion, and Experian in that it does not collect any information. ClearScore was created to allow consumers to access their scores without having to pay the monthly fees charged them by credit reference agencies. Users are entitled to a monthly credit report that contains information from their Equifax credit reports.

WHAT ARE CLEARSCORE PROS & CONS?

Pros

Equifax reports and credit scores are free.

It provides free identity protection, which reduces the chance of being a victim of identity theft or fraud.

It will help you find credit products from a variety of financial institutions that it partners with. This is especially useful for people with lower credit ratings who might not know which providers to approach.

Cons

ClearScore’s credit report can have inaccuracies, as with all credit reports.

WHAT ARE THE CLEARSCORE CREDIT RATINGS

Let’s take a look at each Clearscore band, and see where they rank on the 0-1000 scale.

Poor – 0-438

Fair – 439 – 530

Good – 531 to 670

Very Good – 671-810

Excellent – 811-1000

WHAT IS A GOOD CLEARSCORE CREDIT RATING IN THE UK?

To be able to reach the Good Clearscore score range, you need to have a credit rating of 531 to 670. A good credit rating is good because it allows you to get credit at lower rates. A poor credit score does not necessarily mean you cannot get credit. Higher interest rates will be charged on credit products you apply for.

IS 800 A GOOD CREDIT SCORE?

1000 is the highest Clearscore score. Scores between 811 to 1000 place you in the Excellent ClearScore range. This level of credit will allow you to borrow the most favorable terms.

WHAT IS THE UK’S AVERAGE CLEARSCORE CREDIT SCORE?

ClearScore has estimated that Equifax’s average credit score of 380 is the average. This score is categorized as ‘fair’ according to the above ranking system.

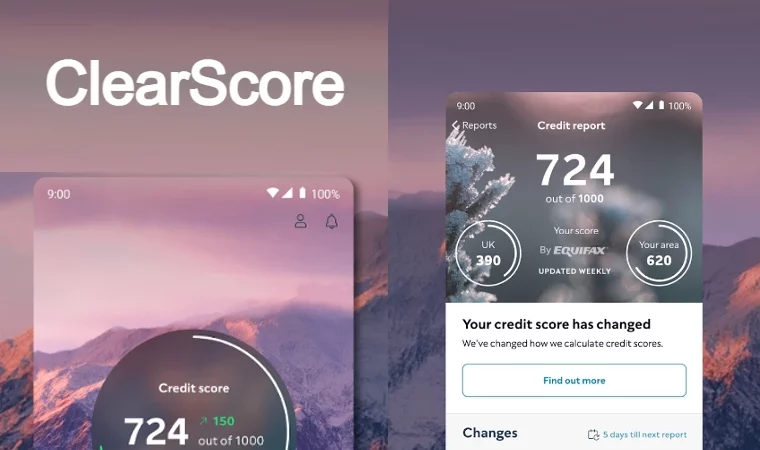

CLEARSCORE APP

The credit score app is available for both Android and iOS users. It allows you to view your credit score anytime you log in, and you can also access your credit report. You can view your credit report to see exactly what a lender will do when you apply for credit. This is a great thing. You have more chances of success if you identify any problems before you apply.

ClearScore can be downloaded for free and used because they make money elsewhere. ClearScore will not only show you your credit score but also credit cards and loans. Lenders are more likely to approve you based on your credit score. ClearScore receives a commission payment if the lender approves your application.

CONCLUSION

ClearScore is simple and straightforward to use. ClearScore is easy to sign up and allows you to track your credit score in great detail. This app is an excellent tool for managing your credit score. It is a wonderful tool that will help you maintain your credit rating. It’s great to see your credit score improve. This is something we should all be concerned about.