Smart Ways To Maintain And Improve Your Credit Score In The UK

Smart Ways To Maintain And Improve Your Credit Score In The UK

Looking to improve your credit score? Your credit score is simply a 3-digit number that indicates your reliability in terms of borrowing and repaying loans. The higher the score the better your ratings which means access to better funds. Your credit score can generally range from extremely poor to excellent. If you live in the UK or anywhere in the world, the credit bureau in the respective regions has ways of calculating the credit scores. The calculation is based on your financial records which build your credit records.

In the UK, TransUnion, Equifax, and Experian are the three main credit reference agencies that publish credit ratings. Different figures mean different ratings for these three agencies. You can easily check your credit score with any of these agencies for free.

What are THE benefits of a good Credit Score?

A good credit score has lots of benefits. Here are some of the few benefits of an improved credit score.

Swift credit approval

You can easily get access to credit facilities such as loans, credit cards, phone contracts and even mortgages with a good credit score.

Lowered Interest Rates

The interest rates are sometimes determined by your credit score. A good credit score means you are creditworthy thus creating cheaper borrowing rates. You can also see some amazing trends at TheMoontrends.

Higher Credit Limits

Credit limits are also another factor that directly links to your credit score. A higher credit limit gives your access to achieve some goals faster and easier.

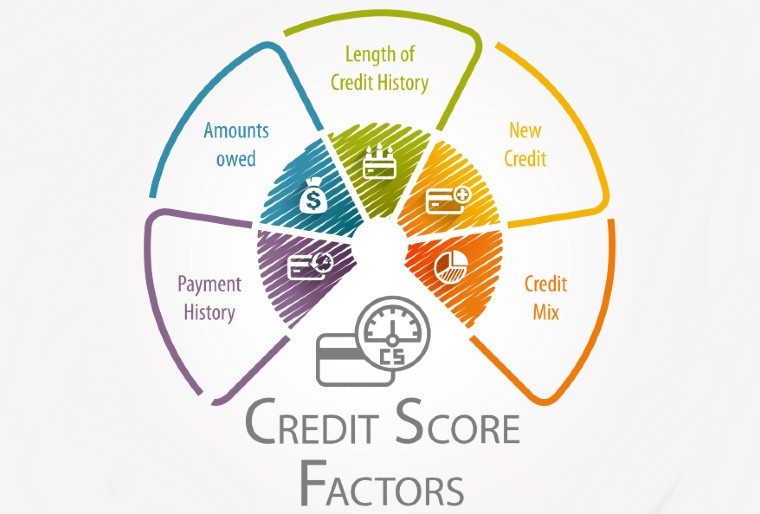

What are the factors affecting your Credit Score?

• Your credit score is based on your credit report which is calculated based on points. Here you can understand how is calculated and know the things that affect your score.

• Missed or late payment history.

• Exceeding your credit limits.

• Having a joint account with a partner that has a poor credit report.

• Applying for credit within a short time span

• Frequent cash withdrawals from your credit card

• Home repossession

• Bankruptcy

• Not registering in the electoral process.

• Count Court Judgements (CCJs)

• Wrong personal information

How To Increase Your Credit Score?

Participate In Electoral Registration Process

One of the easiest ways to increase your credit score is by registering to vote in your locality. Ensure to give your accurate information and lenders often use the data to verify your name and address. A mismatch in any of the details could be a red flag. Lenders take seriously the information from the electoral process to validate your details before approving an application. To avoid delay or being turned down, make sure to register to vote in your area.

Show, You Are CreditWorthy

You need to show the lenders that you are creditworthy by borrowing and repaying on time. A good history of borrowing and repaying on time shows the lender you are creditworthy. But if you have never borrowed, how would they understand your creditworthiness? So, consider taking a small loan and repaying even before the time limit. Maybe take an overdraft or a simple credit card without a high limit. You can use the funds from the overdraft to get some good items from Thestarsmedia.

Avoid Late Payments

Early repayment can help build your credit score. Missed or late payments are a red flag to lenders. Lenders often access your last 12 months’ credit record. If you missed any payment within that period, it would negatively affect your credit score. Additionally, avoid spending above your credit card limit. Keep an eye on your finances and keep them within your limit.

Double-Check for Mistakes

Double-check your loan application form for any errors which could delay your application. Pay attention to the figures especially previously paid loans be sure the figures tally. Any form of mistake could impact your chances of getting a loan.

No Multiple Applications

Having too many loan applications can show off as a sign of being desperate for a loan. You could come off as someone who is struggling and desperately needs the loan. A ‘quotation search’ would do you better instead of a ‘credit application search’ during loan applications. Your lender can help you with this.

Do Not Use Multiple or Join Accounts

Stay away from joint accounts, especially with someone with a bad credit report. A joint account with someone with negative reports such as a mortgage, or overdraft will automatically be linked to your name. You will inherit such reports, and this will affect your reputation.