A Guide to Cross-Border Wealth Management for Prillionaires

The world is your oyster, but is your wealth management strategy keeping pace with your global ambitions? In today’s interconnected world, many prillionaires – individuals with complex financial lives spanning borders – require sophisticated strategies to navigate the intricacies of cross-border wealth management. This guide explores the unique considerations and opportunities that come with managing wealth across international borders, empowering you to take charge of your financial future with confidence.

Challenges and Considerations: Charting the Global Financial Landscape

Cross-border wealth management presents a unique set of challenges that demand careful consideration. Here are some key areas to navigate:

Navigating Tax Complexity: A Global Challenge: Taxation in cross-border wealth management isn’t just a hurdle; it’s a dynamic labyrinth of varying rates and regulations. Your residency status combined with the differing tax treaties and liabilities across countries can dramatically affect financial outcomes. Consulting with a tax adviser who specialises in international taxation is not just recommended; it’s essential for optimising your strategy to meet global tax efficiencies. An upfront understanding of these tax implications is crucial for making informed decisions that protect your wealth internationally.

Regulatory Environment: A Patchwork of Rules: Investment regulations, reporting requirements, and compliance standards can vary greatly between countries. Does your wealth manager possess a deep understanding of the specific regulations in the countries where you hold assets? Working with a professional well-versed in the relevant regulations can help you stay compliant and avoid unnecessary complications.

Mastering Currency Volatility: Protect Your International Assets: The impact of currency fluctuations on your international investments can be profound and unpredictable. Are you equipped with robust strategies to safeguard against this volatility? Understanding and mitigating the risks of currency movements through sophisticated strategies such as hedging is not just a protective measure—it’s a critical component of securing your international wealth against the unpredictable nature of global markets.

Estate Planning: A Global Jigsaw Puzzle: Estate planning becomes even more complex when dealing with international assets. Inheritance laws and the potential for double taxation across jurisdictions add another layer of challenge. Have you considered the impact of international estate planning on your legacy? Consulting with an estate planning attorney with expertise in cross-border matters can ensure your wishes are carried out smoothly.

Strategies for Success: Building a Bridge to Your Financial Goals

While cross-border wealth management presents challenges, it also offers exciting opportunities. Here are some key strategies to consider:

Diversification Across Borders: Spreading Your Wings Diversifying your assets geographically can help mitigate risk and potentially tap into new investment opportunities. Have you explored the benefits of geographically diversifying your portfolio across different countries and asset classes? Spreading your wealth across borders can provide greater stability and growth potential.

Structuring Your Holdings: Building a Strong Foundation Utilising structures like trusts or holding companies can offer advantages for managing your international assets efficiently. Have you discussed the potential benefits of using asset holding structures with your wealth manager? Exploring these options with a qualified professional can help you achieve optimal tax efficiency and asset protection.

Building a Cross-Border Team: Assembling the A-Team Managing wealth across borders requires a team approach. Have you assembled a team of qualified professionals, including a wealth manager, tax adviser, and legal counsel, with expertise in relevant jurisdictions? Working with a team of experts can provide comprehensive guidance and ensure all aspects of your cross-border wealth management strategy are addressed.

Communication and Transparency: Keeping the Lines Open Clear communication and transparency with your advisers are critical for success. Do you regularly communicate your financial goals, risk tolerance, and overall investment strategy with your wealth management team? Open communication ensures your advisers have the information needed to make informed decisions on your behalf.

Prillionaires: Your Data Dashboard for a Global Viewpoint

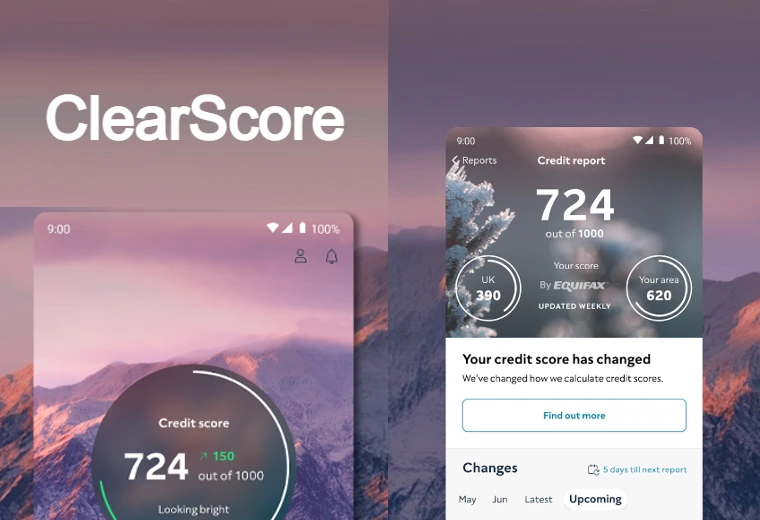

Managing wealth across borders often involves juggling logins for various investment platforms, banks, and retirement accounts, potentially denominated in different currencies. This can make it challenging to get a real-time, consolidated view of your overall financial health.

Prillionaires offers a powerful solution for prillionaires. By securely connecting your financial accounts from around the world, Prillionaires provides a centralised platform for:

- Aggregating Account Information: Effortlessly consolidate your holdings and track performance across various asset classes and geographical locations.

- Real-Time Data and Reporting: Gain instant insights into your global portfolio’s performance with comprehensive reports that update automatically.

- Multicurrency Management: View your wealth in a unified way, with clear breakdowns and insights into currency fluctuations’ impact.

Prillionaires empowers you to make informed decisions with real-time data and a holistic understanding of your global wealth. It serves as a valuable tool within your comprehensive cross-border wealth management strategy, but remember, it shouldn’t replace the guidance of experienced professionals like tax advisers and wealth managers.

Conclusion: Embark on Your Global Financial Journey with Confidence

Cross-border wealth management requires a proactive approach, careful planning, and the expertise of qualified professionals. By understanding the challenges and opportunities presented by the global financial landscape, you can develop a comprehensive strategy that safeguards your wealth and propels you towards your long-term financial goals.

Beyond the Basics: Emerging Trends in Cross-Border Wealth Management

The world of cross-border wealth management is constantly evolving. Here’s a glimpse into some emerging trends:

- The Rise of Fintech: Technological advancements are transforming the wealth management industry. Fintech solutions can streamline cross-border transactions, automate reporting, and provide real-time data analysis, empowering prillionaires to make data-driven decisions.

- Cybersecurity Concerns: As wealth management becomes increasingly digital, cybersecurity threats become more prominent. Implementing robust security measures and partnering with providers who prioritise data protection are crucial for safeguarding your assets.

- Sustainable Investing: Prillionaires are increasingly seeking investment opportunities that align with their values. Sustainable investing strategies that consider environmental, social, and governance (ESG) factors are gaining traction in the cross-border wealth management space.

Taking Action: Charting Your Course

Cross-border wealth management can be complex, but it doesn’t have to be overwhelming. Here are some steps you can take to get started:

- Conduct a Financial Inventory: Create a comprehensive overview of your global assets and liabilities. This will help you understand your current financial landscape and identify areas for optimisation.

- Seek Professional Guidance: Assemble a team of qualified professionals with expertise in cross-border wealth management. This team should include a wealth manager, tax adviser, legal counsel, and potentially a financial planner specialising in international matters.

- Develop a Customised Strategy: Work with your team to develop a customised strategy that reflects your unique financial goals, risk tolerance, and global circumstances.

- Embrace Continuous Monitoring: The global financial landscape is constantly shifting. Regularly review your strategy and adjust it as needed to ensure it remains aligned with your evolving goals and the changing environment.

By following these steps and leveraging the valuable insights from this guide, you can embark on your global financial journey with confidence, navigating the complexities of cross-border wealth management and achieving your long-term financial aspirations.