Building Generational Wealth: A Legacy Beyond Your Years

Imagine a world where your financial decisions not only secure your own future but pave the way for generations to come. This isn’t a pipe dream; it’s the very essence of building generational wealth. It’s about creating a financial legacy that empowers your children, grandchildren, and even great-grandchildren to pursue their dreams, access quality education, and navigate life’s challenges with a safety net.

But where do you begin? Building generational wealth isn’t just about accumulating a large sum of money; it’s about laying a solid foundation of financial literacy, responsible planning, and open communication within your family.

This guide equips you with the knowledge and strategies to embark on this rewarding journey. We’ll delve into the core principles, explore practical steps, and uncover some lesser-known secrets to building wealth that transcends generations.

The Bedrock of Generational Wealth

Three fundamental pillars support a strong foundation for generational wealth:

-

Financial Planning: Just like building a house, creating a financial legacy starts with a blueprint. A comprehensive financial plan assesses your income, expenses, debts, and future goals. It guides your budgeting, saving, and investment decisions, ensuring you stay on track to achieve your financial aspirations.

-

Investing for Growth: Time is your greatest ally in building wealth. The power of compound interest allows your money to grow exponentially over time. By starting early and investing consistently in a diversified portfolio, you can harness this potent force to build a significant financial corpus for future generations.

-

Estate Planning: Don’t leave your legacy to chance. Estate planning ensures your assets are distributed according to your wishes after your passing. This includes creating a will, exploring trusts, and considering beneficiary designations on retirement accounts and life insurance policies.

Building Blocks for a Lasting Legacy

Now that we understand the foundational principles, let’s explore practical strategies to translate them into action:

-

Embrace the Power of Early Starts: The magic of compound interest is undeniable. Starting even a small investment early allows it to grow significantly over time. Encourage your children to develop healthy financial habits and start saving early, perhaps with a simple piggy bank or a dedicated children’s savings account.

-

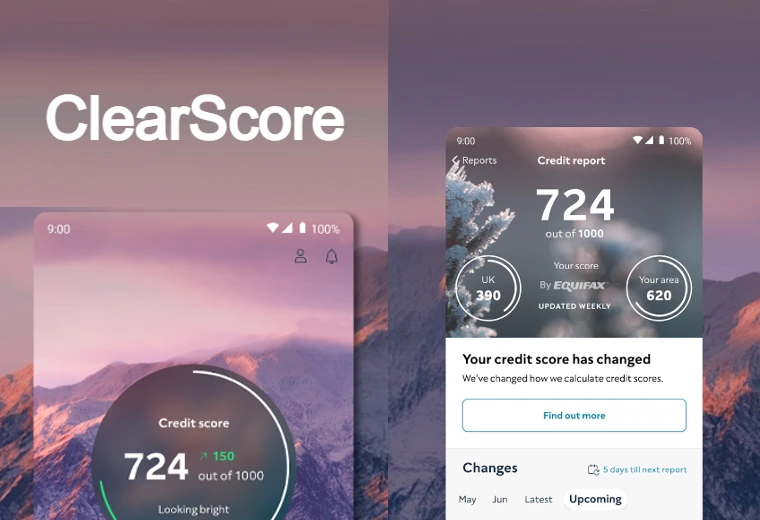

Prioritise Saving: Living below your means is crucial. Track your expenses using a net worth tracker. This tool helps you visualise your financial progress and identify areas where you can cut back. By consistently saving a portion of your income, you build the base capital for future investments.

-

Open Communication is Key: Financial matters shouldn’t be shrouded in secrecy. Talk openly with your family about your financial goals and aspirations. Discuss estate planning strategies and involve your children in age-appropriate ways. This fosters transparency, builds trust, and ensures a smooth transition for future generations.

-

Instill Financial Literacy: Financial literacy empowers individuals to make informed financial decisions. Equip your children with the knowledge they need to manage their money effectively. Encourage them to ask questions, research investment options, and develop critical thinking skills regarding money matters.

-

Explore Tax-Efficient Strategies: Taxes can significantly impact your wealth accumulation. Seek professional advice on tax-efficient wealth transfer strategies like gifting allowances and lifetime ISA (Individual Savings Account) contributions. Remember, minimizing tax burdens allows more of your hard-earned money to be passed on to future generations.

Beyond the Basics: Unveiling Hidden Gems

While the core principles remain constant, building generational wealth in the 21st century requires exploring some lesser-known avenues:

-

Leverage Technology: Take advantage of online financial management tools and budget planners. These resources help track expenses, analyze investments, and set financial goals. Utilize online resources to educate yourself and your family on personal finance topics.

-

Embrace Alternative Investments: While traditional stocks and bonds form a strong foundation, consider alternative investments like real estate crowdfunding or peer-to-peer lending. These options can diversify your portfolio and potentially offer higher returns. However, due diligence and understanding the risks involved are crucial.

-

Invest in Yourself: Your greatest asset is your earning potential. Continuously develop your skills and knowledge to increase your career prospects and earning power. This translates into more resources to invest and create a lasting financial legacy.

Challenges and Considerations

Building generational wealth is a marathon, not a sprint. It requires consistent effort, discipline, and the ability to adapt to changing circumstances.

Here are some potential hurdles to anticipate:

-

Market Fluctuations: The financial markets are not immune to ups and downs. Develop a long-term investment strategy and maintain a diversified portfolio to weather market downturns. Remember, time in the market is often more important than timing the market.

-

Changing Family Dynamics: Blended families or unforeseen circumstances might necessitate adjustments to your estate plan.

-

Regularly review your estate plan to ensure it reflects your current family structure and wishes. Consider seeking legal advice to adapt your plan to accommodate any significant life changes.

-

The Human Factor: Financial planning isn’t just about numbers; it’s about your family’s values and goals. Open communication is crucial to ensure alignment between your vision for generational wealth and your family’s aspirations. Involve your loved ones in discussions to foster a sense of shared responsibility and ownership over the legacy you’re building.

Securing Your Family’s Financial Future

Building generational wealth is an attainable goal with careful planning, proactive management, and a commitment to open communication within your family. Here are some steps to take action:

- Download our free guide to “Estate Planning Basics.” (Link to downloadable resource) This comprehensive guide offers a roadmap for navigating the essential elements of estate planning.

- Schedule a consultation with a financial advisor. A qualified financial professional can assess your unique situation, recommend personalized strategies, and guide you on maximizing your wealth-building potential.

- Invest in a net worth tracker. (Link to your net worth tracker product) This tool provides a clear picture of your financial health, allowing you to track progress and make informed decisions about your financial future.

Building a Legacy Beyond Money

While financial security is a cornerstone of generational wealth, it’s not the sole focus. Consider these additional elements to cultivate a well-rounded legacy:

- The Value of Education: Equipping your family with a strong educational foundation empowers them to pursue their dreams and secure fulfilling careers. Prioritize educational expenses for future generations, whether through college savings plans or scholarships.

- The Importance of Values: Financial resources alone don’t guarantee a successful life. Instill strong values like hard work, responsible living, and philanthropy in your family. These values will serve as a guiding light for future generations, ensuring your legacy extends beyond just monetary wealth.

- The Power of Giving Back: Consider incorporating charitable giving into your wealth transfer strategy. This allows you to leave a positive impact on the world while simultaneously teaching your family the importance of philanthropy.

Building generational wealth is a journey, not a destination. By embracing these strategies, fostering open communication, and prioritizing both financial well-being and strong values, you can create a lasting legacy that benefits your loved ones for generations to come.

-