Financial Planning Software and Tools: Create Comprehensive Financial Plans

Are you looking to improve your financial situation but feeling overwhelmed by all the options available? Financial planning software and tools can be a great way to take control of your finances and create a comprehensive plan for achieving your financial goals.

This article will explore the benefits of using software and tools for financial planning, the available types, and how to choose the right ones for your needs. Whether you’re looking to budget more effectively, plan for retirement, or better understand your finances, financial planning software and tools can help you get there.

So, let’s dive in and start taking steps toward a more secure financial future with our comprehensive financial plan guide!

Key Benefits of Utilizing Financial Planning Software and Tools

As we said earlier, financial planning is essential to managing your finances and achieving financial success. Yet, it can be a daunting and time-consuming task.

These tools streamline financial planning, making it more efficient and less overwhelming. Here are some of the highlighted benefits of using this financial software which makes you able in finance management, Wealth management, and Tax planning.

Streamlining the financial planning process

Financial Advisor software and tools make organizing and tracking your finances easy. They allow you to input your income, expenses, and savings goals and generate a comprehensive financial plan. This plan can be customized to suit your specific needs and goals and can be updated as your financial situation changes.

With these tools, you can see where your money is going and make informed decisions about how to manage it.

Achieving financial success

Financial Analysis and Planning tools can help you achieve your financial goals. They allow you to set savings goals and track your progress toward achieving them. They also help you plan for major expenses, buy a home, or retire.

Simplifying the financial planning process

These tools can simplify the process by providing an easy-to-use interface and step-by-step guidance. They take the guesswork out of financial planning and make it accessible to everyone, regardless of their financial knowledge or experience. With these tools, you can create a comprehensive financial plan that fits your unique needs and goals.

We bet that financial planning software and tools are valuable for managing your finances and achieving financial success. They streamline the financial planning process, make it more efficient, and help you stay on top of your finances.

If you want to improve your financial situation, consider using Prillionaires financial planning app. This can simplify your financial planning process, making it accessible to everyone.

Different Types of Financial Planning Software and Tools Available

- Budgeting software: helps you plan and track your expenses, creating a balanced budget.

- Investment planning tools assist in making informed decisions about investing in stocks, bonds, and other securities.

- Retirement planning software: Assists in planning a comfortable retirement, including saving, investing, and managing your assets.

- Personal finance management Helps manage all aspects of personal finances, including budgeting, expenses, investments, and debts.

- Wealth management software: Supports creating a comprehensive financial plan, including investments, insurance, taxes, and estate planning.

- Tax planning tools: Assists in tax planning, including estimating tax liability, maximizing deductions, and preparing tax returns.

- Asset allocation software: Helps you determine the right mix of assets to reach your financial goals and manage risk.

- Debt management software: Assists in managing debt, including creating a debt repayment plan, tracking progress, and monitoring credit.

- Cash flow management Helps manage cash inflows and outflows, ensuring a positive cash flow to meet your financial obligations.

- Estate planning software: Assists in creating a comprehensive estate plan, including wills, trusts, and other legal documents.

- College savings planning: helps plan for the cost of education, including creating a savings plan, choosing investments, and tracking progress.

- Risk management tools: Assists in managing risk, including identifying potential risks, developing a risk management plan, and monitoring progress.

- Portfolio management software: Supports managing a portfolio of investments, including tracking performance, making informed decisions, and managing risk.

Top 5 Best Financial Planning Software and Tools for 2023 Reviewed

Prillionaires:

Prillionaires has evolved into a top-rated personal finance software with bank-level security, enabling the management of multiple bank accounts, financial assets and liabilities, all while calculating your net worth effortlessly. The software now offers multi-currency functionality accessible on both desktop and mobile devices, a transparent overview of all your linked monetary accounts, the ability to add and manage multiple crypto wallets, track investments and brokerage accounts, and monitor the value of properties and cars with its net worth calculator. It includes a budgeting tool, investment tracking, and debt management tools, alongside personalized financial advice for a well-rounded financial planning experience.

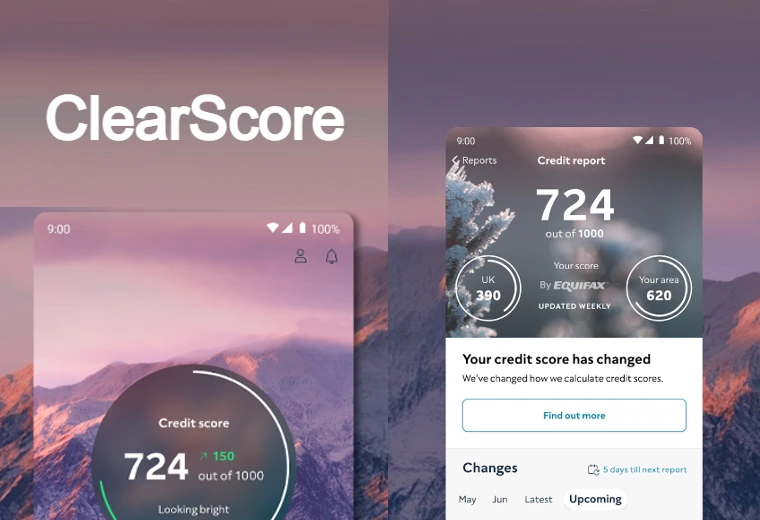

Personal Capital:

Personal Capital is a financial planning software focusing on investment management. It offers a range of tools for tracking your investments, including a portfolio tracker and retirement planner. The software also provides personalized financial advice and access to certified financial advisors, aiding you in achieving your financial goals.

Mint:

Mint is a popular financial planning software that offers a range of features to help you manage your finances. It includes a Bill Tracker for managing bill payments, Daily Budget Planner for analyzing daily spending and custom budgeting, Credit Score Monitoring for tracking your credit score, Alerts feature for real-time notifications on spending, account balances, and credit score, and Portfolio and Investment Tracking for monitoring investment accounts including 401(k) and IRAs.

Quicken:

Quicken is a comprehensive financial planning software that offers a range of features to help you manage your finances. It includes bill tracking and bill pay in the Premier and Business & Home packages connecting to over 11,500 digital network billers, and the unique business and rental property features in the Home & Business package aiding in property investment and tenant tracking. The robust tax planning features in the Home & Business package support tax schedules A, B, C, and E.

YNAB (You Need a Budget):

YNAB is a budgeting-focused financial planning software that offers a range of tools to help you manage your finances. It includes budgeting tools, financial tracking, and a mobile app for on-the-go access to your finances. The software also offers personalized financial advice and access to a community of users for support and guidance. New for 2023, YNAB introduced YNAB Together for supporting shared financial goals and YNAB’s Loan Planner for effectively planning loan repayments.

These are the 5 best financial planning software for 2023. Whether you are looking for a comprehensive solution or need help with budgeting, these financial planning software and tools offer a range of features to help you improve your financial situation.

Tips for Choosing the Right Financial Planning Software and Tools

Identifying your financial goals

The first step in choosing the right financial planning software or tools is identifying your financial goals.

It could be determining what you want to achieve with your finances, such as paying off debt, saving for retirement, or building wealth. By clearly understanding your financial goals, you can ensure that the software or tools you choose will help you meet those goals.

Assessing your current financial situation

Before choosing financial planning software or tools, assessing your current financial situation is essential.

It includes reviewing your income, expenses, debts, and assets. This information will help you determine your financial standing and will help you choose software or tools that are suitable for your needs.

Evaluating your risk tolerance

Another essential factor to consider when choosing financial planning software or tools is your risk tolerance.

This refers to your willingness to accept financial risk to achieve a particular goal. Different software and tools offer different levels of risk, so it is essential to choose one that is in line with your risk tolerance.

Researching different options

Once you have assessed your financial situation and evaluated your risk tolerance, it is time to research different options.

Many different comprehensive Financial Plan planning software and tools are available on the market, each offering different features and benefits. It is essential to compare these options and choose the one best suited to your needs.

Choosing software or tools that integrate well with your existing financial system

Finally, when choosing financial planning software or tools, it is essential to consider how well they integrate with your existing financial system.

Choosing software or tools that integrate well with your existing financial system will help you quickly and efficiently track your finances.

Conclusion

Using financial planning software and tools can have a significant impact on your financial success. They can help you create a comprehensive financial plan, track your progress, and make informed financial decisions.

When choosing financial planning software or tools, you must consider your financial goals, current financial situation, risk tolerance, and the ability to integrate with your existing financial system.

Doing so can create a comprehensive financial plan to help you meet your financial goals and achieve financial success.[/vc_column_text][vc_toggle title=”What are the main benefits of using financial planning software?”]Financial planning software streamlines budgeting, investment tracking, and debt management, allowing users to gain a clear view of their financial status. It provides an organized platform to set, track, and achieve financial goals, making financial planning accessible and less intimidating. Moreover, it aids in informed decision-making which is crucial for financial success.[/vc_toggle][vc_toggle title=”How do I choose the right financial planning software for my needs?”]Identify your financial goals, assess your current financial situation, and understand your risk tolerance. Research various software, compare their features, and ensure they integrate well with your existing financial systems. It’s also beneficial to choose software with good customer support and positive user reviews.[/vc_toggle][vc_toggle title=”Can financial planning software help with investment decisions?”]Yes, many financial planning software offer investment tracking and planning tools that help users make informed investment decisions. They provide a platform to track investment performance, manage portfolios, and offer insights on potential investment opportunities based on your financial goals and risk tolerance.[/vc_toggle][/vc_column][/vc_row]