Marks and Spencer Online Banking – Review

Looking for information on Marks and Spencer Online Banking? This article provides comprehensive details on M&S Online Banking, including customer service reviews and tips for 2024.

M&S is a well-known British retailer with a long history of providing high-quality products and services. Recently, the company expanded into the online banking market, offering competitive products and services via its website. M&S Bank offers current accounts, savings accounts, credit cards, loans, mortgages, and insurance products.

In this review, we’ll examine M&S’s online banking products and services and evaluate their competitiveness in 2024 and beyond.

Marks and Spencer Bank

Marks and Spencer Bank is a subsidiary of the British retailer Marks and Spencer. The bank offers a range of banking services, including mortgages, credit cards, savings accounts, insurance products, pension schemes, and investment advice. In addition to physical branches throughout the UK, M&S Bank operates an extensive network of call centres to assist with any questions or issues you may have with your account.

If you’re looking for a reliable digital bank that offers great customer service, consider Marks & Spencer Bank.

Marks and Spencer Bank Customer Service

Marks and Spencer Bank remains one of the most popular banks in the UK in 2024. Their customer service is excellent, with representatives always willing to help. However, customers should ensure they have enough money in their account to cover unexpected charges or fees that may arise while using the online banking platform.

If something goes wrong with a transaction, whether it’s an error on their part or a problem with another company’s system, their team is ready to resolve the issue quickly.

Marks and Spencer Bank Account

The Marks & Spencer bank account offers many features that make it attractive to consumers. Users can access their money globally without fees or charges for international transfers. The bank provides 24/7 customer support via phone or online chat, useful for any issues with accessing funds or making transactions. While some features are unique compared to other banks, M&S Bank is a quality product for those seeking an easy-to-use financial institution with numerous benefits not found at traditional banks.

M&S Credit Cards – Compare

M&S credit cards are a great way to access high-interest rates and flexible borrowing options in 2024. The M&S Credit Card range includes unsecured personal loans, secured personal loans, car finance, and more. The cards are suitable for everyday purchases like groceries and clothes.

M&S offers a simple selection of credit cards with excellent 0% purchase or balance transfer offers. If you prefer a friendlier client experience than a traditional high street bank, the M&S credit card is a great option.

Types of M&S Credit Cards:

- Purchase Card: Spread out upcoming expenses without paying interest.

- Balance Transfer Card: Reduce current interest expenses by transferring balances with a low balance transfer fee and 0% interest rate.

- Rewards Card: Earn points with every use, which convert to vouchers mailed every three months.

All M&S credit cards are compatible with mobile payment systems like Apple Pay, Samsung Pay, and Android Pay.

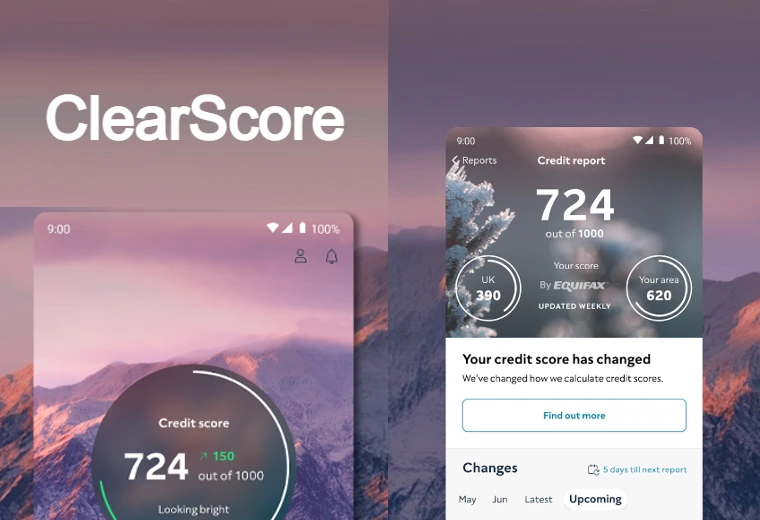

M&S Banking App

The M&S banking app is an excellent way to keep track of your finances and manage transactions in 2024. It offers an easy-to-use interface for daily commerce, accessible from any device, ensuring you always have access to your money. The app features include setting up automatic payments, viewing transaction history, and applying for loans or credit cards. The M&S Banking App also supports biometric authentication such as fingerprint or face recognition for added security.

Digital and Physical M&S PASS

To enhance security, M&S Bank provides both a digital M&S PASS and a physical M&S PASS. The digital M&S PASS generates a single-use security code every time you sign in to internet banking, ensuring your account is safe. For those who prefer not to use the digital version, a physical M&S PASS is available and functions similarly to provide secure access.

M&S Online Banking FAQs

Is M&S Online Banking safe?

Yes, M&S Online Banking is very safe. It uses advanced security measures such as encryption and two-factor authentication to protect your personal information and financial transactions. Additionally, features like the digital M&S PASS generate a single-use security code every time you sign in, and you can also use fingerprint or face recognition for added security.

Can I use M&S Online Banking abroad?

Yes, you can use M&S Online Banking abroad without additional fees or charges. The service allows you to manage your finances, transfer money, and make payments from anywhere in the world, making it convenient for international use.

How do I contact M&S Online Banking customer service?

You can contact M&S Online Banking customer service 24/7 via phone or online chat. The online chat feature is available on their website and in the M&S Banking App, providing immediate assistance whenever you need it.

What are the interest rates for M&S Online Banking?

The interest rates for M&S Online Banking vary depending on the product or service. M&S Bank offers competitive rates for current accounts, savings accounts, loans, and mortgages. For the latest rates, visit the M&S Bank website or check the M&S Banking App for detailed information.

Regulatory Compliance

M&S Bank is regulated by the Prudential Regulation Authority and the Financial Conduct Authority. This dual regulation ensures that the bank adheres to strict standards of conduct, protecting customers’ interests and maintaining the integrity of the financial system.

Conclusion

Marks and Spencer Bank remains a reliable and innovative banking solution in 2024. With its strong association with HSBC and excellent customer service, M&S Bank is a great choice for those seeking a modern, digital banking experience.

Whether you need a new bank account, credit card, or loan, M&S Bank has a suitable product. With competitive interest rates, global access without fees, and 24/7 customer support, M&S Bank is a top choice for online banking in 2024.