Managing Money: 3 Ways To Protect Your Savings

It’s the dream of many of us to grow our savings and protect our financial future. So, how do you keep your savings not just safe, but also primed for growth? Let’s explore pragmatic strategies to protect and enhance what you’ve worked hard to accumulate.

Diversification

When it comes to financial protection, diversification is the golden rule – and we’re not just talking metaphorically. Splitting your investments across various asset classes can cushion your savings against market volatility. Stocks, bonds, property, and cash savings all play their parts, but there’s also a tangible asset that often glitters during times of uncertainty: gold.

Investing in gold isn’t a novel concept; it has been a traditional form of saving for centuries. Why? Because its value isn’t directly tied to any single economy’s health. You can buy gold coins in the UK online through expert sites, providing a convenient entry point into this asset class. By holding a portion of your savings in gold, you can introduce a historical bulwark against inflation and currency devaluation.

Emergency Funds

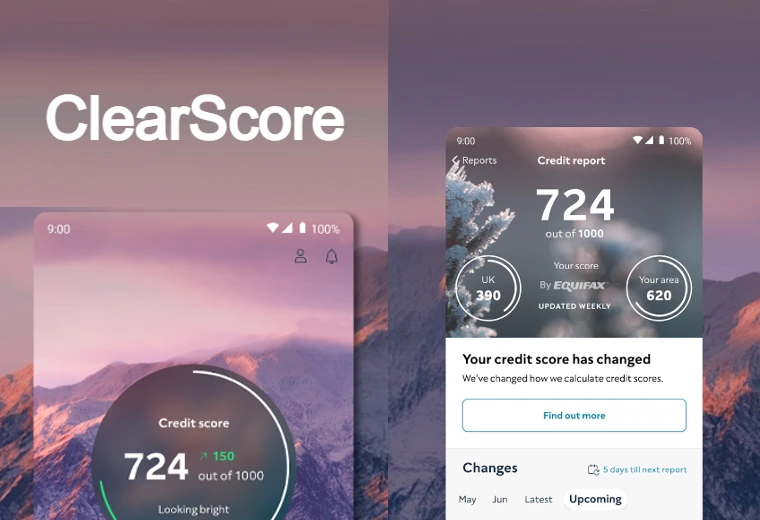

Before we venture further into the avenues of investment, there’s a fundamental step that mustn’t be overlooked: establishing an emergency fund. This is your financial safety net, designed to catch you during life’s unexpected falls. An ideal emergency reserve should cover around three to six months’ worth of living expenses. Having this buffer can prevent you from dipping into long-term savings or investments when sudden needs arise.

Constructing this safety net begins with regular contributions to a dedicated savings account. Opt for an instant access cash ISA or a high-interest savings account where your money can grow, yet remains readily available. The security it provides isn’t just financial; it’s the peace of mind knowing that you’re prepared for life’s hiccups, whether they be minor repairs or more serious financial emergencies.

A Balanced Portfolio

Now, let’s return to the concept of a balanced portfolio. A varied investment approach isn’t just throwing your funds into different pots and hoping for the best; it’s a deliberate strategy to optimize your savings’ growth potential while mitigating risk. Each type of investment comes with its own set of risks and rewards, and understanding these can significantly impact your ability to protect your savings.

Equities, for example, can offer higher returns, but they’re also subject to market fluctuations. Bonds, alternatively, generally offer more stability but with lower potential returns. Property can provide rental income and potential capital growth, yet it’s illiquid and requires maintenance. Cash savings offer security and liquidity, but the returns can be meagre, especially in a low-interest-rate environment. Striking the right balance between these can help maintain your savings’ buying power over the long term.

Conclusion

In conclusion, protecting your savings is less about employing complex strategies and more about embracing practical, time-tested principles of money management. It’s about diversification, including tangible assets like gold, building and maintaining an emergency fund, and crafting a balanced investment portfolio that aligns with your financial goals and risk tolerance.