Mastering Your Finances: The Ultimate Guide to ROI and IRR

Hello, financial aficionados! Whether you’re a seasoned investor or just starting on your financial journey, understanding key metrics like Return on Investment (ROI) and Internal Rate of Return (IRR) is crucial. So, grab a cuppa, and let’s dive into the world of ROI and IRR.

The ABCs of ROI and IRR

In the world of finance, acronyms are as common as rain in the UK. Two of the most important ones are ROI and IRR. ROI, or Return on Investment, is a measure used to evaluate the efficiency or profitability of an investment. It’s calculated by dividing the net profit from an investment by the cost of the investment, then multiplying the result by 100 to get a percentage.

IRR, or Internal Rate of Return, on the other hand, is a metric that estimates the profitability of potential investments. It’s the discount rate that makes the net present value of all cash flows from an investment equal to zero.

The Art of Calculating ROI

Calculating ROI is as straightforward as a Sunday roast. You simply take the gain from the investment, subtract the cost, then divide by the cost. The ROI formula looks like this:

ROI = (Net Profit / Cost of Investment) * 100%

This calculation gives you a percentage that represents the profitability of your investment. For example, if you invest £100 in a stock and sell it for £150, your ROI would be 50%.

Navigating the Complexities of IRR

Calculating IRR, however, is a bit more complex, like trying to understand the rules of cricket. It involves finding the discount rate that makes the net present value of cash flows from an investment equal to zero. This can be a bit tricky, but thankfully, there are plenty of online calculators that can help you calculate IRR.

Using ROI and IRR to Evaluate Investments

ROI and IRR are powerful tools in the investor’s toolkit. By comparing the ROI and IRR of different investments, you can identify which ones are likely to give you the best returns. This can help you make informed decisions about where to put your money, whether you’re investing in stocks, bonds, real estate, or even a new business venture.

The Importance of Context in ROI and IRR Calculations

While ROI and IRR are valuable tools, they’re not without their limitations. Both metrics are based on estimates of future cash flows, which can be uncertain. They also don’t take into account the risk of an investment. For example, an investment with a high IRR might also have a high risk of loss. It’s important to use ROI and IRR in conjunction with other metrics and qualitative factors when evaluating investments.

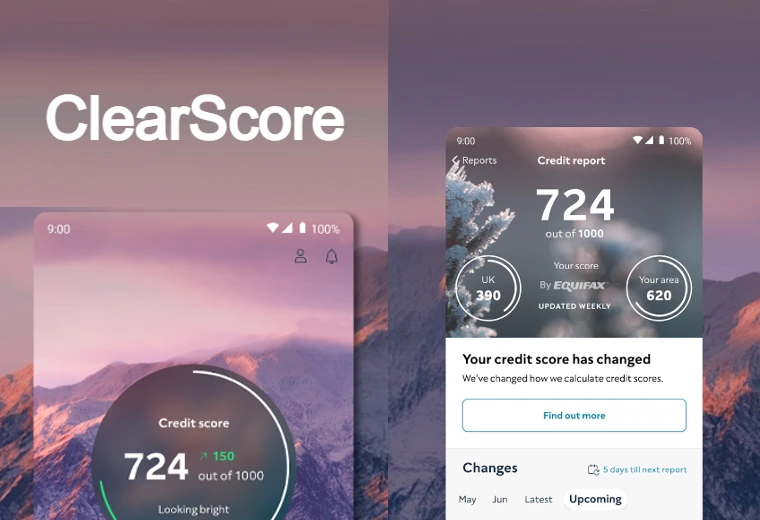

The Prillionaires Advantage

In the complex world of investing, having the right tools can make all the difference. Prillionaires offers a comprehensive wealth tracking and net worth calculator app, allowing you to monitor your investments and calculate returns with ease. Whether you’re calculating the IRR for a new business venture or tracking the ROI of your stock portfolio, Prillionaires has you covered.

Conclusion: Taking Control of Your Financial Future

Understanding how to calculate returns is a vital skill for any investor. By mastering metrics like ROI and IRR, you can make informed decisions, evaluate your performance, and ultimately, increase your wealth. Sign up for early access to the Prillionaires app today and take control of your financial future. After all, the journey to becoming a prillionaire starts with understanding where you stand. So, what are you waiting for? Embark on your financial journey today![/vc_column_text][vc_toggle title=”What is the difference between ROI and IRR?”]ROI, or Return on Investment, is a simple measure that tells you the percentage return on an investment. It’s calculated by dividing the net profit from an investment by the cost of the investment. On the other hand, IRR, or Internal Rate of Return, is a more complex metric that estimates the annual growth rate an investment is expected to achieve. It’s the discount rate that makes the net present value of all cash flows from an investment equal to zero.[/vc_toggle][vc_toggle title=”How can I use ROI and IRR to evaluate my investments?”]ROI and IRR are powerful tools that can help you evaluate and compare the profitability of different investments. By calculating the ROI, you can quickly assess the efficiency of an investment, while the IRR can help you estimate the potential growth of an investment over time. However, it’s important to use these metrics in conjunction with other factors, such as risk and market conditions, when making investment decisions.[/vc_toggle][vc_toggle title=”Can I use the Prillionaires app to calculate ROI and IRR?”]Yes, the Prillionaires app offers a comprehensive wealth tracking and net worth calculator that can help you monitor your investments and calculate returns, including ROI and IRR. By using Prillionaires, you can easily track your financial progress and make informed decisions to help grow your wealth.[/vc_toggle][/vc_column][/vc_row]