Make Your Desktop a Financial Planning Hub

Effective financial management is key in both personal and business realms. Gone are the days when managing money meant piles of paperwork or basic spreadsheets. The digital era has revolutionized this, making financial planning more efficient and user-friendly. Now, your desktop can be more than just a work tool; it can be your financial command center, helping to manage money more effectively. A tip for Mac users: learning how to turn off desktop click sounds, labeled as mac turn off desktop click, can enhance your focus while managing finances.

Evolution of Budgeting Tools

The journey from traditional paper methods to advanced digital solutions has reshaped the way we handle our finances:

- Transition to Digital Tools: Moving from manual spreadsheets to automated desktop software has streamlined the budgeting process.

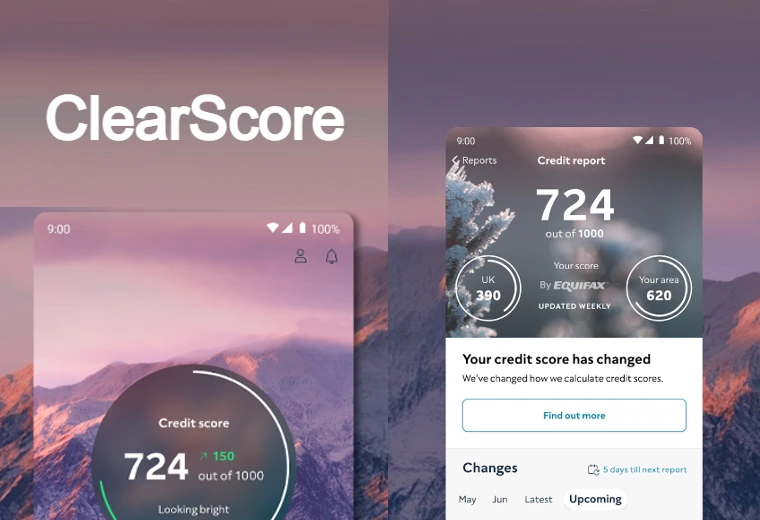

- Mobile Apps for On-the-Go Finance: The emergence of smartphone apps has brought financial management to our fingertips, offering convenience and instant financial updates.

- Key Budgeting Applications: Names like Prillionaires, Personal Capital, and YNAB have become synonymous with efficient financial management, offering a range of features from expense tracking to investment oversight.

These advancements have not only simplified budget management but also enhanced its accuracy, empowering users to make well-informed financial decisions.

Grasping the Fundamentals of Budgeting

Understanding budgeting basics is essential before exploring sophisticated tools. This knowledge will help you embark on an effective financial management path.

Assessing Your Financial Picture

Start by getting a clear view of your financial landscape. This involves knowing your income, regular expenses, and any debts or savings. A simple step is to list your income and monthly expenses, offering a snapshot of your financial health.

Establishing Achievable Financial Objectives

The foundation of good budgeting lies in setting achievable financial targets. These could range from saving for special occasions to long-term investment plans. Clear, attainable goals keep you focused and driven.

Monitoring Expenditure

A vital aspect of budgeting is keeping an eye on your spending. This can be as straightforward as recording daily expenses or utilizing a budgeting app to categorize and oversee your expenditure.

With these basics in place, you’re better equipped to use budgeting tools effectively, smoothing your journey to financial well-being.

Seamlessly Integrating Budgeting Tools into Your Desktop Workflow

Here’s how to blend budgeting software into your daily desktop use, enhancing your financial management:

- Selecting the Ideal Tool: Choose software that fits your financial needs, like Prillionaires for personal budgets or Adaptive Insights for business finances.

- Synchronize Your Financial Accounts: Link your software with your bank and credit card accounts for automated income and expense tracking.

- Activate Alerts: Set reminders for bills and budget limits to stay on track.

- Personalize Your View: Tailor the software’s dashboard to highlight key information like upcoming bills or spending patterns.

- Regular Reviews: Consistently check your financial status and adjust as needed.

With these steps, integrating budgeting tools into your desktop environment becomes a streamlined, efficient process.

Tackling Typical Budgeting Hurdles

Budgeting can come with its share of challenges, but they are not insurmountable with the right approach.

Maintaining Budget Discipline

Staying true to your budget requires commitment. To make this easier, begin with small, achievable changes to your spending habits and build from there.

Handling Unexpected Costs

Life’s surprises, like sudden medical bills or car repairs, can disrupt your budget. An emergency fund is a safety net for such scenarios. Start building this fund, even if it’s with small amounts.

Keeping the Motivation High

It’s easy to feel constrained by a budget. To stay motivated, focus on the bigger picture: the financial independence and peace of mind that budgeting brings.

Finishing Thoughts

Mastering the art of budgeting is crucial for sound financial health, both personally and in business. Setting realistic goals and effectively using the right tools gives you more control over your finances. Remember, budgeting isn’t about limiting yourself; it’s about efficiently managing your resources.

As you progress in your financial journey, be flexible and open to adjusting your strategies. With determination and the right tools, achieving your financial aspirations is within reach.